When looking for a POS or Point of Sale system for your business it is important to purchase it based both on your current operational needs as well as your future expansion plans and goals. POS systems allow you to process sales using a variety of payment methods, be it:

- Cash

- Credit

- Debit

And allows you to issue a receipt either electronically or physically. A good POS, will also typically help you with other administrative tasks such as:

- Inventory management

- Price adjustment

- Sync in-store and online purchases

But that is just the tip of the iceberg because there is a large variety of POS systems to choose from – starting with ones which are very basic and free and ending with others which are extremely advanced and cost a monthly fee. The type of POS system you choose will necessarily vary depending on the type of business you run and the size and nature of that business. An online clothing retailer with one physical location will have different needs than a cafe who sells paraphernalia and ground coffee beans online. So too will a person who only sells in bricks & mortar or who only dabbles in eCommerce – though the former is becoming somewhat of an anomaly while the latter is becoming more of the norm. Either way, all commerce requires a good, sleek, POS which will streamline activity and make sure each sale is ‘captured’ in the securist and most organized of ways.

In this post we will learn everything there is to know about a POS system:

- What is a POS system and how does it work?

- When do you need a POS system?

- How to choose the right POS system for your business?

- How much does a POS system cost?

- Are there free POS systems?

- What are some of the benefits of using a POS system for credit card processing?

- What are some of the differences between POS systems and cash registers?

What is a POS system and how does it work?

Ok, so I already explained the basics of what a Point of Sale or POS system is but in order to simplify it, a POS system is actually just like a standard cash register except much more intelligent and with a wider variety of capabilities. A POS system is made up of 3 main elements:

- Hardware – The hardware component allows you to accept payments and so when purchasing a new POS system, make sure that it accepts the forms of payment most frequently used by your customers. This may include:

- Cash

- Credit cards including ones with ‘smart chips’

- Mobile payments such as Apple Pay

Other hardware functions may include:- Printing receipts

- Storing cash

- The ability to scan barcodes, SKUs, EANs ( to learn more about this, you can read The Ultimate Guide to Amazon identifiers: SKU, ASIN, EAN)

- Software – This is the intelligence aspect of the system and the more advanced the system the smarter it is. The more basic POS systems allow you to:

- View items in your inventory

- Calculate the total amount owed by the customer

And the more advanced systems are able to perform tasks related to:- Inventory syncing

- Customer engagement

- Sales reporting

- Payment – Beyond simple payment tasks, some POS systems can transfer funds directly to your bank account even from sources like PayPal.

When do you need a POS system?

Small, medium and large businesses can all benefit from having a POS system especially if you:

- Accept credit and debit cards

- Need to keep track of sales and inventory

Having a system which can electronically track each and every minute inventory shift and in many cases provide you with advanced information such as:

- Which items are most popular ?

- What time of year an item is popular?

- When you need to restock ?

These are just a few examples of the type of data you can benefit from when using a POS system and is really crucial. Imagine you run an online clothing store and your POS picks up on a pattern that a specific sweater is extremely popular in winter, between January and February. Not only that but your POS system further tells you that last year you sold 1,000 pieces of said item. This will help you be prepared for the coming winter and hopefully not over or under stock a particular item. This is a fantastic indicator though do keep in mind that quantities may fluctuate from year to year.

Here are some additional questions you should be asking when deciding which POS system is right for you:

- Which features does this POS system have and what is most important for my individual business? These may include:

- Inventory management

- Loyalty program management

- Ability to issue invoices and receipts

- Storing customer information securely

- Data analytics

- What type of payments can this POS system accept and which form of payment do most of my customers use ? This may include:

- Apple Pay

- PayPal

- Cryptocurrencies such as Bitcoin

- Android Pay

- Chip based cards

- How secure are payments and customer data ? It is crucial to have a POS system customers can trust especially if you are a new and/or small business trying to earn trust.

- Which features on your new POS system are free and which cost money?

- Make sure to compare at least three systems before making your final decision.

- What are the monthly processing fees that you will be charged (such as chargeback fees)?

- What is the cost to process a payment ? Is it a percentage per sale or a flat per transaction rate or a combination of both ?

- Also, don’t forget that many times you need to buy extra equipment and that these come either with purchase or rental fees – be sure to include these as well in your calculations

What are some of the benefits of using a POS system for credit card processing?

Of course you do not need a POS system in order to accept credit card payment. Many people have credit card machines. But there are some benefits associated with having a POS system when processing credit cards:

- First off, a POS system will track and record all the credit card and transaction info which is super important especially in the long run. Many times you can have issues with payments, credit card companies and customers and can’t find the receipt. Often it is not in the interest of these large companies to provide you with the necessary info you need to make a claim – that is where your POS system debuts center stage.

- Some POS providers offer a sort of chargeback insurance. This means that if a customer buys something from you and then proceeds to dispute the charge, the POS provider will cover you no matter what the outcome (whether or not the credit card company decides in your favor). The amount covered varies on the provider and can be $100 or $250. Whatever the amount, this is a serious benefit and can allow you some peace of mind when running a business.

What are some of the benefits of using a POS system for credit card processing?

Different POS systems are beneficial for different types of businesses and really varies depending on parameters such as:

- Business size

- Sales turnover

- Marketing goals

- Forms of payments made by your consumer base

Here are some examples of different types of businesses and how this may affect their POS system needs and choice:

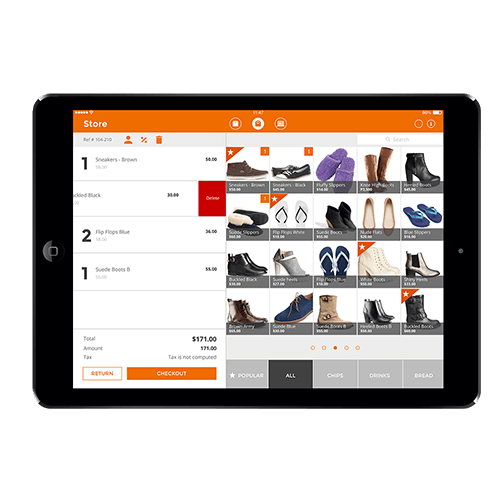

- A small retail store with an eCommerce presence – In this case you you will need a POS system which:

- Is able to sync online and in-store inventory levels

- Has hardware such as a barcode scanner and a receipt printer

- You may also want a POS with a marketing system which can help you keep in touch with customers and communicate special deals and promotions

- A business with an online presence but no permanent physical location – This option is very popular today as eCommerce businesses have a strong online presence which they choose to strengthen by opening pop-up stores and visiting trade fairs in order to connect with their clientele. In this case, you may be in the market for a mobile POS system. Lookout for a system which:

- Comes with a portable credit card reader which can fit into your pocket and plug into your tablet, iphone or Android’s headset jack.

- Has a credit card chip reader if you see most of your customers are using cards with chips

- Comes with an offline mode so that you can still take payments even when there is no internet

- Includes the ability to issue invoices and receipts

- Has inventory tracking and syncing capabilities

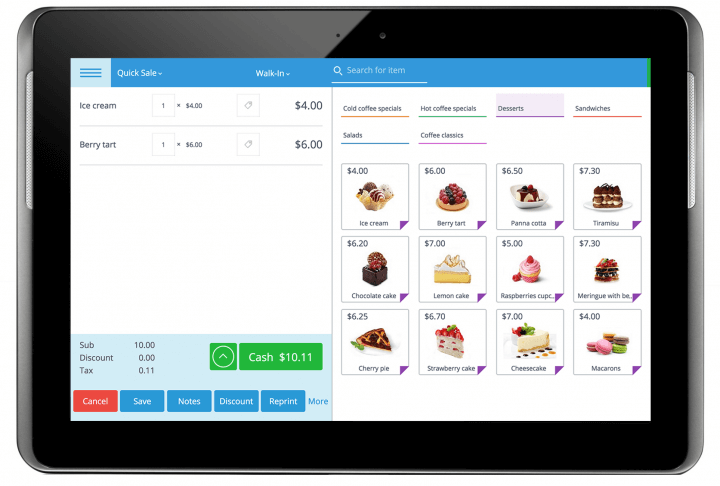

- A coffee shop or restaurant with an online presence – Think Starbucks. But not only, many cafes and restaurants which are individually owned and not necessarily part of a franchise, are honing an online presences. Many cafes are cashing in on local coffee drinkers by selling them t-shirts, mugs and ground coffee online. The online-offline combo can work great in many scenarios but does require some thought when choosing the right POS system which should:

- Be able to update the digital menu flawlessly

- Communicate with kitchen staff, employees and customers effectively

- Print kitchen tickets for the chefs, receipts and invoices for customers and restocking reports for suppliers

- Be able to split a bill between multiple diners and keep an open tab for customers who will pay at the end of the night

- Sync merchandise

- Handle online orders

How much does a POS system cost?

Each POS provider has a different fee scheme. Many times there is more than one company involved, each with its own set of fees. This may include:

- A POS software provider monthly fee which fluctuates based on the size of your business and sales volume.

- A POS hardware provider may be the same as your software provider or separate. Either one may charge a one time fee, a rental fee or split the fee into monthly payments in addition to an annual fee.

- Merchant services is another fee which needs to be taken into consideration and may charge monthly fees and/or per transaction fees as well as a PCI compliance fee, a set of payment card industry standards which exist in order to ensure that payment security is maintained.

All these services can cost as little as $60 a month and up, depending on your business’s needs – in terms of percentage this can cost between 0.36% and 0.9% per transaction over the course of any given month.

Also, don’t forget to keep your eyes and ears open for extra fees which may include:

- A fee for having multiple locations

- Paying for full customer support

- Hidden card processing fees which often appear in the fine print

Are there free POS systems?

Surprisingly enough, and counter to common knowledge there is such a thing as free POS software! As far as the hardware goes, you will have to put up the cash. These items may include:

- Registers

- Scanners

- Printers

- Desktop computers or tablets

Here are three completely free POS systems you may want to consider:

- eHopper

This software was designed to help small businesses on a budget. The free version is limited and recommended for people with one small store location.

Free features include:

- Contact management

- Inventory management

- Employee management

- Integration with tablets and Windows desktops

Limitations include:

- Integration with one credit card processor

- Limited customer support

- Limited to one register

The non-free version will run you $40 per register.

2. Imonggo

The biggest benefit of this one is that you can manage 1,000 products and 1,000 transactions a month for free.

The biggest downsides include:

- It is internet based and as such only good for businesses with a good, high-speed broadband connection

- Credit card integration is not free!

- It is limited to a single location

The paid version will run you a relatively low $30 per month, per location.

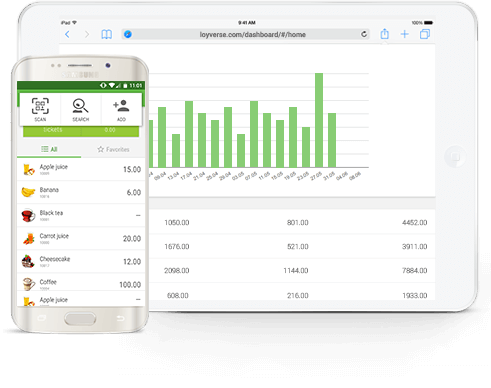

3. Loyverse POS

This is completely free and is an app meant to be installed on IOS or Android devices. Loyverse is built on the premise of creating customer loyalty and comes complete with an app which the customer is encouraged to download.

The customer app includes:

- A loyalty program

- Push notifications from yours truly

- Customer discounts

- QR codes which can be used in-store and online

The business owner’s app allows you to:

- Send out promotional material

- Create a loyalty program

- Manage discounts

- Work offline

- Integrate with Vantiv (a leading US credit card processing company) for credit card payments

- Do inventory management

- Do employee reporting

Did I mention that the paid version is also completely free since it is non existent :)!?

What are some of the differences between POS systems and cash registers?

Think of a cash register as the extremely unintelligent cousin and the POS system has the high- functioning, multitasking, widely successful family member. Comparisons aside, cash registers are outdated and can fulfill the most basic of functions including:

- Recordings sales

- ‘Giving’ change

- Storing money

That is it folks!

Most cash registers can’t even accept credit card payments. On the other hand POS systems often include:

- Credit card payment hardware

- The ability to transfer funds to your account

- Sales reports and analytics

- Marketing tools

- Customer relationship management

These functions clearly outweigh that of a cash register and if your business can afford it I would highly recommend getting a POS system which can help you save money by making decisions such as where to focus your marketing strategy and how many employees to have in a given shift based on customer analytics.

Summing it up

A POS system is mandatory for any business which respects itself and is attempting to compete in the modern age. A POS system helps you streamline business management from inventory to checking out and keeping track of your business activity. The interconnectedness that POS systems provide you with give you a clear market advantage. Consider the fact that you will be able to:

- Cross reference and sync all online, mobile and in-house sales

- Cross reference your sales data and marketing strategy in order to create targeted and tailored customer engagement

- Manage costs vis-a-vis managing inventory and staff

As I mentioned above, for those of you who are worried about costs, there are free software options and hardware can be obtained cheaply when rented, leased or bought second hand from a company going out of business. Definitely put POS systems on your to do list for the 2018-2019 fiscal year.

Please share your good and bad experiences with POS software and hardware.

Stories of outdated cash registers will also be warmly welcomed 😉